Table of Content:

- Introduction

- What is Big Data?

2.1 The advanced evolution of big data

2.2 Succeeding regulatory hurdles

2.3 Big data as a key enabler of financial services modernization for Fintech Companies

- How Big Data Helps the Fintech and Banking Industry?

3.1 Customer Segmentation

3.2 Fraud Detection

3.3 Risk Management

3.4 Personalised Services with Big Data Analytics

3.5 Better Compliance Capabilities

- Final Thoughts

1. Introduction

Everything related to technology includes data. Financial services in blending with technological advancements have radically reshaped the way they work.

While the first impression of hearing the words ‘technology’ and ‘banking’ in one order is still linked to online payments, transactions, internet banking, and apps, however, these services are just the tip of the iceberg.

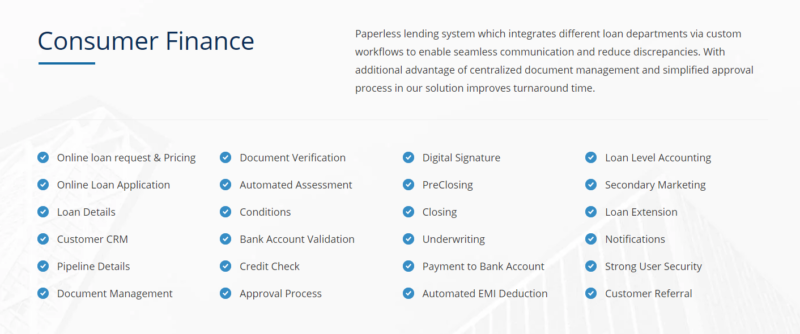

Thus, opting for reliable service providers with a plethora of services is the best option for your customized consumer finance requirements. Have a look at the image below centering on the different sorts of expertise that you should anticipate from your provider.

Image Source: TatvaSoft

The global fintech industry is proceeding to thrive, and its ambition to embrace artificial intelligence (AI) and big data analytics remain predominant.

The development comes from the volume of data generated by our electronic gadgets. Since more and more people change digital banking, data becomes more important and more prominent, getting an apparent name — Big Data.

Enthusiastic and effective, the 20,000 or so Fintechs currently working globally apprehend AI, machine learning (ML) and big data explanations will be the keystones for progress or failure shortly.

These technologies will empower them to adapt their contributions in a market where race is intense and the speed of innovation is fast and ruthless.

As a result, the appropriation of AI, ML and big data analytics is the rate of admission to the main function in banking and finance because possible partners or customers require fintech that reaches out and delivers much more than the status quo.

The mainstream finance sector is already employing AI and Big Data solutions, where the best-known deployments cover algorithmic trading, market monitoring, and fraud detection.

In algorithmic speculation, big data analytics enables versatility and elegance that no person can meet. The major market titles utilise this technology to produce large businesses throughout the day without triggering inopportune price changes.

While financial data analytics facilitates risk-based pricing, AI can spot questionable patterns of intimate fraud or money laundering.

Let’s Understand big data and its role in the success of Fintech!

2. What is Big Data?

As earlier discussed, big data consists of all data accumulated by our electronic devices, both structured and unregulated, which can be treated with special algorithms and analysis techniques to handle and extort valuable items of data regarding the user.

This data can be utilized afterward in various fields, depending on the parties concerned. In the Fintech quarter, Big Data can be utilized to predict customer response, but also to generate protective procedures and methods for alternative banks and financial institutions from all around the globe.

Each day, over the world, around 2.5 quintillion bytes of data are created.

2.1 The advanced evolution of big data

Big data’s service will grow side-by-side with the evolution of the Internet of Things (IoT), improving mobile technology, and more excellent authentication methods.

Fintech companies will, hence, advance to focus on the growth and processing of data by actively spending in data science fields.

For instance, most companies rely on big data to improve the established analytic tools and credence scoring algorithms that form the grounds of our company.

Such advancements have created new lending opportunities for the earlier underbanked and underserved public.

Data science and fintech are connected thoroughly, and collectively they will reverse the conventional approach to managing business before the decade is out.

This will be especially possible in advanced fraud detection and preventive security, where gathering and interpretation of data – rapidly and accurately – will present unprecedented security.

Similarly, complete customer outlines, customer segmentation, personalized financial services, and process computerization are other fields that big data will change in the upcoming future.

2.2 Succeeding regulatory hurdles

For big data to absolutely recognize its enormous potential, however, a radical shift in the regulatory framework is needed.

Regulators still appear to stick in an antiquated mentality that deters them from unfastening big data’s true circumstances.

The pandemic has unveiled the value of a robust digital financial system, especially in developing markets.

To perform this in the decade where the unbanked progress online, regulators must receive a centralized database by combining and gathering data from other regulatory bodies such as financial institutions, insurers, telephone corporations, aggregators, and payment assistance.

This type of centralized database is agile and empowering but also pledged to mitigating risk and managing the safety and safety of all stakeholders.

Fintech companies could then enter the aggregated data with full customer permission to give them services.

Positively, when we begin from pandemic lockdown we will have a more elevated affection for the digital tools that we become habituated to, and regulators will understand that digital options to traditional services are available after all.

All suggestions are that these services will convert more pervasive, seamless, and customer-focused for the upcoming time.

2.3 Big data as a key enabler of financial services modernization for Fintech Companies

Big data has transformed content creation for the financial services industry.

Providers continually strive to innovate and develop their tools, services, and contributions to intensify customer support and exceed their competitors.

In this strain, big data and machine learning are essential. They enable fintech companies to create the typically protracted and valuable tasks of account risk scoring and charges faster and affordably.

Developing markets are the prime beneficiaries, as they sometimes have an approved credit registry.

These technologies are also capable of preparing mobile phone methods and payments data more efficiently, to help banks in rising markets experience credit opportunities.

Furthermore, the capacity to design new credit risk standards for nano- and micro-finance interests the underbanked by presenting a broader variety of options and entrance to the financial interstate.

Therefore, regulators, banks, and mobile network operators are required to join deals with fintech providers to fully utilize big data for the terminal advantage of the customer, in the years to develop.

And this rate is required to improve furthermore shortly. Well, all this data can be practiced in various highly important ways, with the guidance of the appropriate accessories and algorithms. But here is the question: how Big Data help Fintech and the banking industry?

3. How Big Data Helps the Fintech and Banking Industry?

3.1 Customer Segmentation

Fintech companies are famous for signifying customer-focused, and customer segmentation is one of their main areas.

The financial industry is concentrated on dealing with its customers as per age, gender, online behavior, economic situation, and geographical coordinates.

In this respect, fintech data management can simply examine spending habits as per your age, gender, and social standing. They can also quickly tailor their help and substitute banking products to satisfy the demand and requirements of each customer segment.

The most important customers, particularly those consuming the most money, can also be recognized. This will create higher levels of customer satisfaction, as people frequently seek extremely personalized suggestions and financial products.

3.2 Fraud Detection

Another benefit of utilizing Big Data in the financial industry is the fraud detection possibilities that it presents.

Certainly, with the growth of online banking and internet transactions, businesses in the division and their customers are more sensitive to fall prey to fraud.

Big Data encourages banks and other financial institutions to completely follow the spending practices of each consumer, but also their general online patterns.

In this example, when abnormal movement is recognized by the enterprise, the owner of the account can be quickly communicated and ask or talked regarding a transaction that seems unusual.

3.3 Risk Management

Risk management is an operation of high consequence in all industries. Repeatedly, in the finance industry, Big Data comes with the enormous power of recognizing possible risks in courses of bad finances or bad payers.

While Big Data cannot entirely limit such risks, it can recognize those at early steps and block further development into risky routes.

Big data can assist companies in the financial industry seamstress programs and procedures that will evaluate the potential risks and decrease those.

3.4 Personalised Services with Big Data Analytics

In the banking and fintech industry, offering personalized services is one of the most comprehensive marketing tools possible.

Fintech companies such as Contis Group demand that more and more customers have sought personalized and compliant fintech services and units.

The requirement to design personalized services in the business is also inspired by the growing number of companies that utilize such strategies, thus where a strong opposition is present.

Alternative banking companies started to adopt the services of fintech data management to develop their services and offer more personalized cases, but also a larger, more complete, faster infrastructure, which creates a more personalized and easy activity for the final consumer.

Not only can fintech companies recognize consuming patterns to make banking support, but they can also practice those to improve the final user and collect more money if this is one of their purposes.

Unlike conventional banking institutions, fintech companies concentrate more on designing personalized financial services that match the very specific requirements of the final consumer, and this is where Big Data is the essential factor.

3.5 Better Compliance Capabilities

Companies that give financial services are constantly expected to comprehend specific rules.

This asks for frequent audits and compliance checks to understand the very specific requirements of the business in times of security, privacy, data analysis, and finance.

Big Data provides provisioning to these companies with important data in terms of consumer demands and expectations concerning those.

Adopting cloud-based data, these companies can immediately use analytics packages and combine those into their operations, enabling them to have a more actionable penetration in this regard.

Furthermore, those businesses in the fintech industry that advance personalized financing decisions can now investigate and discover where a financial emergency is more prone to occur and adjust their plans to follow some severe preventive measures.

Final Thoughts

The fintech industry is developing at a fast pace, and beginning with internet banking services, companies in the division have improved their abilities and the financial services allowed.

The most important customers, particularly those employing the most money, can also be recognized. This will produce more extraordinary levels of customer delight, as people usually seek extremely personalized proposals and financial products.

Another benefit of utilizing Big Data in the financial industry is the fraud detection possibilities that it opens. With the rise of online banking and internet transactions, companies in the field and their customers are more responsive to becoming victims of fraud.

Machine learning and artificial intelligence appear to initiate new paths in all industries and the alternative finance sector looks to also profit greatly from those. Eventually, this interprets into better, more personalized assistance for both B2B and B2C customers.

Read Dive is a leading technology blog focusing on different domains like Blockchain, AI, Chatbot, Fintech, Health Tech, Software Development and Testing. For guest blogging, please feel free to contact at readdive@gmail.com.